Comparing apartment lease agreements and hidden fees is crucial for securing your dream rental without unexpected financial burdens. Navigating the world of rental agreements can feel like deciphering a legal code, especially when sneaky hidden fees lurk within the fine print. This guide breaks down everything you need to know, from understanding basic lease components to spotting those pesky extra charges before they hit your bank account.

We’ll arm you with the knowledge to become a savvy renter and avoid costly surprises.

From understanding standard lease clauses to identifying common hidden fees like pet fees, late payment penalties, and cleaning charges, we’ll cover it all. We’ll compare different lease structures – month-to-month versus fixed-term – highlighting their advantages and disadvantages. We’ll even delve into legal aspects, ensuring you’re aware of your rights and responsibilities as a tenant. Ultimately, this guide empowers you to make informed decisions and secure a rental agreement that’s both fair and financially manageable.

Understanding Lease Agreement Basics

Navigating the world of apartment rentals can feel overwhelming, especially when confronted with lengthy and complex lease agreements. Understanding the key components of your lease is crucial to protecting your rights and avoiding unexpected costs. This section will break down the essential parts of a typical lease, helping you confidently sign on the dotted line.

A standard apartment lease agreement Artikels the terms and conditions of your tenancy. It’s a legally binding contract between you, the tenant, and the landlord or property management company. Failing to understand these terms can lead to disputes and financial repercussions. Therefore, taking the time to thoroughly read and understand your lease is an investment in your peace of mind.

Standard Components of a Lease Agreement

A typical lease agreement includes several key sections. These generally cover the names and contact information of both parties, the property address, the lease term (start and end dates), the monthly rent amount, security deposit details, late payment penalties, and procedures for lease termination. Beyond these basics, clauses addressing pet policies, subletting, guest restrictions, and responsibilities for repairs and maintenance are also common.

Crucial Sections Requiring Careful Review

Renters should pay particularly close attention to clauses detailing the payment of rent, late fees, and the process for addressing maintenance issues. The section outlining the landlord’s responsibilities for repairs and the tenant’s responsibilities for maintaining the property are also critical. Furthermore, clauses regarding lease renewal, early termination fees, and the process for returning the security deposit warrant careful scrutiny.

Scrutinizing apartment lease agreements is crucial; those hidden fees can really sting! Finding the best deal often involves considering location, and that’s where checking out resources like best affordable apartments near public transportation becomes invaluable. Once you’ve found a potential place, remember to double-check the fine print – you’ll want to avoid any unexpected costs after signing on the dotted line.

Any ambiguities or unclear language should be clarified with the landlord before signing.

Examples of Common Lease Clauses

Many leases include clauses regarding prohibited activities, such as illegal drug use or excessive noise. Others specify the consequences of violating lease terms, which might include eviction or financial penalties. Some leases include clauses that limit the number of occupants allowed in the unit. Finally, clauses related to the use of common areas and parking are frequently included.

Understanding these clauses ensures that you are aware of your rights and responsibilities as a tenant.

Lease Term Comparison Across Rental Property Types

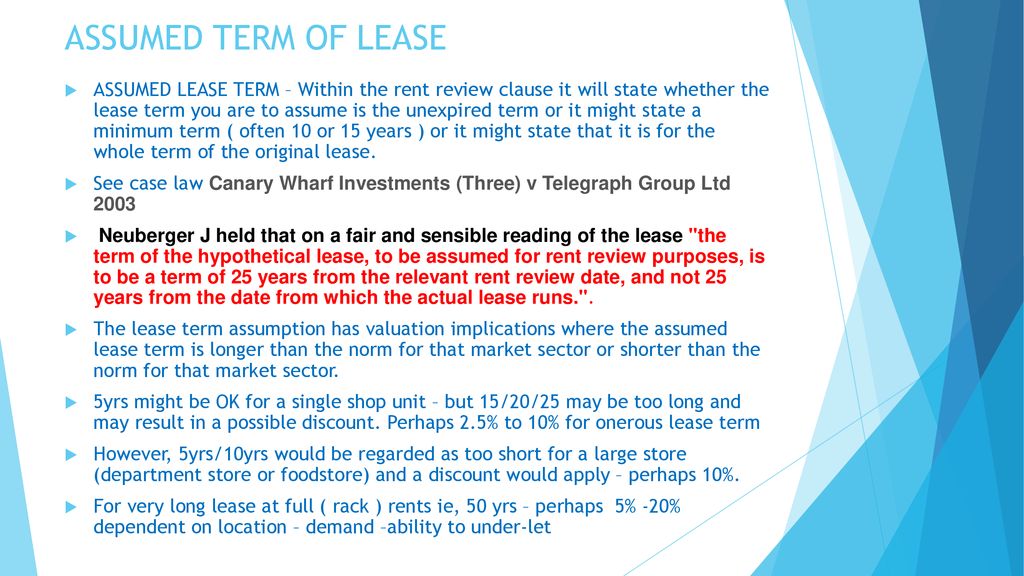

The table below illustrates how certain lease terms might vary depending on the type of rental unit. Note that these are examples and actual terms can differ significantly based on location, landlord policies, and market conditions.

| Lease Term | Studio Apartment | 1-Bedroom Apartment | 2-Bedroom Apartment |

|---|---|---|---|

| Average Monthly Rent (Example) | $1,200 | $1,500 | $1,800 |

| Security Deposit (Example) | $1,200 | $1,500 | $1,800 |

| Late Fee (Example) | $50 | $50 | $50 |

| Pet Deposit (If Applicable, Example) | $300 | $300 | $400 |

| Lease Term Length (Common) | 12 months | 12 months | 12 months |

Identifying Hidden Fees in Lease Agreements

Finding your dream apartment is exciting, but the paperwork can be a real headache. One major source of post-move-in surprise and frustration? Hidden fees. These sneaky charges can significantly inflate your monthly rent, turning a seemingly affordable apartment into a budget-buster. Understanding how to spot these fees before signing is crucial to avoiding financial pitfalls.

Common Hidden Fees in Lease Agreements

Landlords sometimes incorporate fees that aren’t explicitly stated upfront. These can add hundreds, even thousands, of dollars to your overall rental cost. Failing to recognize these charges can lead to significant financial strain.

- Application Fees: While application fees are common, excessively high fees should raise a red flag. Some landlords charge separate fees for credit checks or background checks, which should be clearly stated.

- Pet Fees: These can include one-time pet fees, monthly pet rent, or even additional security deposits specifically for pets. Ensure these fees are clearly Artikeld, including any breed restrictions or weight limits.

- Parking Fees: While some apartments include parking, many charge extra for designated parking spots or garage spaces. The cost can vary significantly depending on the location and availability.

- Amenity Fees: Access to amenities like gyms, pools, or clubhouses may incur additional monthly fees. These fees are often not included in the advertised rent price.

- Early Termination Fees: These penalties can be substantial if you need to break your lease early. Understand the terms and conditions related to early termination before signing the agreement.

- Late Fees: Late rent payments often result in significant penalties. It’s essential to understand the exact amount and the grace period allowed before late fees are applied.

Impact of Hidden Fees on Total Rental Cost

The cumulative effect of these seemingly small fees can be substantial. For instance, a $50 monthly pet rent, a $100 parking fee, and a $25 amenity fee add up to an extra $175 per month, or $2100 annually. This is a significant increase on top of your base rent, potentially impacting your overall budget and financial planning. Imagine these costs added to potential late fees or early termination fees; the financial burden could become overwhelming.

Strategies for Identifying Hidden Fees During Lease Review

Thoroughly reviewing your lease agreement is paramount. Don’t rush the process; take your time and read every clause carefully. If anything is unclear, ask for clarification. This proactive approach can save you from unexpected expenses later.

- Read the Entire Lease: Don’t just skim; read every word, including the fine print. Look for any clauses related to additional fees or charges.

- Ask Questions: If anything is unclear or ambiguous, don’t hesitate to ask the landlord or property manager for clarification.

- Compare Leases: Before signing, compare the lease agreement with those from other properties to see if fees are significantly higher or lower than the average.

- Get Everything in Writing: Ensure all agreed-upon terms and conditions, including any fees, are clearly documented in the lease agreement.

Checklist for Spotting Hidden Fees

A comprehensive checklist can help you systematically review your lease for potential hidden fees.

| Fee Type | Check for… |

|---|---|

| Application Fees | Specific breakdown of costs (credit check, background check, etc.) |

| Pet Fees | One-time fees, monthly rent, breed restrictions, weight limits |

| Parking Fees | Cost per space, availability, type of parking (covered, uncovered) |

| Amenity Fees | List of amenities and associated fees, access limitations |

| Early Termination Fees | Specific penalties and conditions for breaking the lease |

| Late Fees | Amount of penalty, grace period for rent payment |

Comparing Different Lease Agreement Structures

Choosing the right lease agreement is crucial for both landlords and tenants. Understanding the nuances of different lease structures can significantly impact your financial stability and living arrangements. This section will break down the key differences between common lease types, highlighting their advantages and disadvantages to help you make an informed decision.

Lease agreements come in various forms, each with its own set of terms and conditions. The most prevalent types are month-to-month and fixed-term leases. While both grant you the right to occupy a property, the level of commitment and flexibility differs considerably.

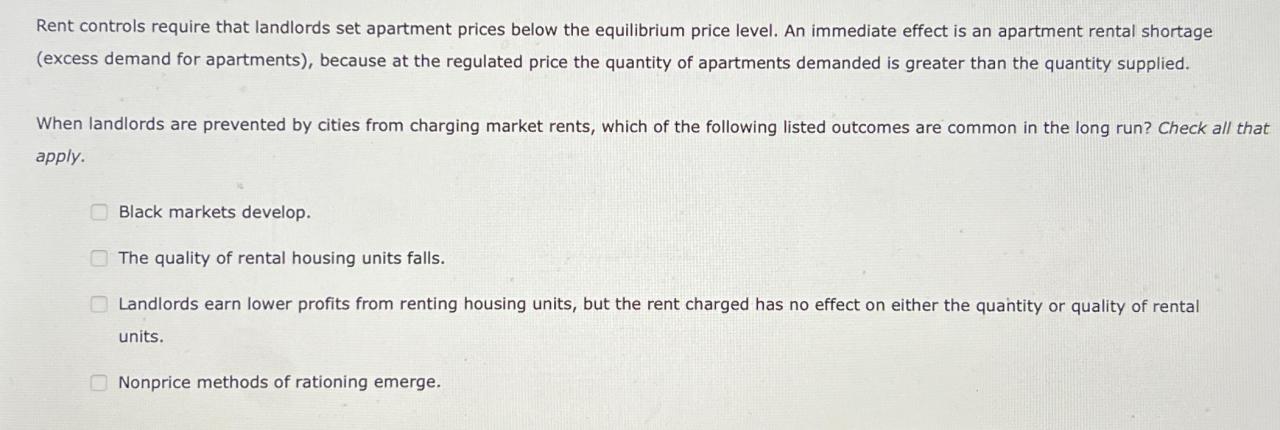

Month-to-Month Lease Agreements

A month-to-month lease, as the name suggests, offers the greatest flexibility. It automatically renews each month unless either party provides proper notice (usually 30 days). This structure suits tenants who anticipate needing to move relatively quickly or are unsure about their long-term plans. However, it often comes with less predictable rent increases and a lack of long-term security.

Landlords often set higher monthly rent for month-to-month agreements to account for the added administrative burden and potential for short-term vacancies. Tenants, on the other hand, enjoy the freedom to terminate the agreement with relatively short notice, albeit with the potential for rent increases each month.

Fixed-Term Lease Agreements

Fixed-term leases, typically lasting six months or a year, provide both tenants and landlords with a sense of security and predictability. The rent amount remains constant throughout the lease period, and both parties are bound by the agreed-upon terms. This stability is attractive to those seeking long-term housing and budget certainty. However, ending a fixed-term lease before its expiration usually incurs penalties, making it less flexible than a month-to-month arrangement.

For instance, a tenant who signs a one-year lease might be required to pay several months’ worth of rent as a penalty if they break the lease early. Conversely, a landlord is guaranteed a consistent income stream for the duration of the lease.

Key Differences Between Month-to-Month and Fixed-Term Leases

The following points summarize the crucial distinctions between these two common lease structures. Understanding these differences will empower you to choose the option that best aligns with your needs and circumstances.

- Lease Duration: Month-to-month leases renew monthly; fixed-term leases cover a specific period (e.g., 6 months, 1 year).

- Rent Stability: Rent in fixed-term leases remains constant; month-to-month leases allow for rent adjustments (usually with notice).

- Flexibility: Month-to-month leases offer greater flexibility to move; fixed-term leases are less flexible and often involve penalties for early termination.

- Security: Fixed-term leases provide greater security for both tenants and landlords; month-to-month leases offer less security for both parties.

- Notice Period: Month-to-month leases typically require 30 days’ notice to terminate; fixed-term leases require adhering to the lease’s termination clause.

Analyzing Fee Transparency and Legal Compliance: Comparing Apartment Lease Agreements And Hidden Fees

Understanding the legal landscape surrounding apartment lease fees is crucial for both landlords and tenants. Hidden fees and unclear lease terms can lead to disputes and legal battles, highlighting the need for transparency and adherence to relevant laws. This section will delve into potential legal issues, clarify the rights and responsibilities of both parties, and offer practical advice on improving fee transparency.

Potential Legal Issues Related to Hidden Fees and Unfair Lease Terms

Landlords who include hidden fees or employ unfair lease terms risk facing legal repercussions. Many jurisdictions have laws protecting tenants from exploitative practices. For instance, charging excessive late fees, arbitrarily increasing rent beyond the terms of the lease, or adding fees not explicitly stated in the agreement can all constitute violations. These violations can lead to lawsuits, fines, and damage to the landlord’s reputation.

Tenants, armed with knowledge of their rights, can challenge such practices and potentially recover unjustly collected fees. A common example involves “admin fees” tacked on without clear explanation or justification, which courts often deem illegal if deemed excessive or arbitrary. Another example could involve undisclosed fees for pest control or cleaning, added after the tenant has signed the lease.

Landlord and Tenant Rights and Responsibilities Regarding Fees

Landlords have a legal responsibility to be upfront and transparent about all fees associated with the rental property. This includes clearly outlining all fees in the lease agreement, providing detailed explanations, and ensuring the fees are reasonable and justifiable. Tenants, in turn, have the right to a clear and understandable lease agreement, free from hidden fees or unfair terms.

Scrutinizing apartment lease agreements is crucial; hidden fees can significantly impact your budget. Finding the perfect place is key, especially when considering factors like proximity to quality schools, which is why researching options like apartments near good schools for families with children is a smart move. Remember, a thorough comparison of lease terms and a keen eye for hidden costs will save you money in the long run.

They also have the right to challenge fees they believe to be unlawful or unreasonable. Open communication between landlord and tenant is key; if a tenant questions a fee, the landlord should be prepared to provide a clear and concise explanation. Failure to do so could expose the landlord to legal challenges. Both parties have a responsibility to understand and abide by the terms of the lease agreement and relevant landlord-tenant laws.

Improving Fee Transparency in Lease Agreements, Comparing apartment lease agreements and hidden fees

Landlords can significantly improve transparency by implementing several straightforward strategies. First, create a detailed and easily understandable fee schedule that is separate from the main lease but clearly referenced within it. This schedule should list every possible fee, its purpose, and how it is calculated. Avoid vague terms like “administrative fees” and instead use specific descriptors such as “late fee,” “pet fee,” or “parking fee.” Secondly, provide prospective tenants with a copy of this fee schedule before they sign the lease, allowing them to review the costs thoroughly.

Finally, ensure the lease agreement is written in plain language, avoiding legal jargon that can be confusing to the average person. Proactive transparency fosters trust and minimizes potential disputes, benefiting both the landlord and the tenant.

Summary of Relevant Landlord-Tenant Laws Regarding Fees

| Jurisdiction | Late Fee Limits | Pet Fee Regulations | Other Relevant Laws |

|---|---|---|---|

| California | Often capped at a percentage of rent, specific regulations vary by locality. | Restrictions on breed or size, limits on fees. | Specific laws governing security deposits, lease termination, and notice requirements. |

| New York | No state-wide cap, but local regulations may apply. | No state-wide restrictions, but local regulations may apply; landlords often require additional security deposits. | Strict regulations on lease terminations and eviction procedures. |

| Texas | Generally allowed, but must be reasonable and clearly stated in the lease. | Landlords can charge pet fees, but they must be disclosed in the lease. | Laws governing security deposits, notice requirements, and lease renewals. |

| Florida | Usually capped, but specific limits vary by city or county. | Fees allowed but must be disclosed and reasonable. | Regulations regarding landlord’s duty to maintain habitable premises. |

Note

This table provides a general overview and should not be considered legal advice. Always consult local laws and regulations for specific details.*

Budgeting for Apartment Costs

Finding your dream apartment is exciting, but the financial reality can quickly dampen the enthusiasm if you’re not prepared. A well-structured budget is crucial for avoiding unexpected financial strain and ensuring a smooth tenancy. This section details how to create a realistic rental budget that encompasses all potential costs, including those often overlooked.

Creating a Realistic Rental Budget

Building a comprehensive rental budget requires meticulous planning. Start by listing all anticipated monthly expenses. This goes beyond the monthly rent; consider utilities (electricity, gas, water, internet), renter’s insurance, transportation costs, groceries, and any subscriptions. Next, factor in less frequent but essential costs such as property taxes (if applicable), HOA fees, and potential repairs or maintenance. Don’t forget to allocate funds for entertainment and personal expenses to maintain a healthy lifestyle.

A realistic budget should also include a buffer for unexpected costs – a safety net to handle unforeseen circumstances. This buffer, ideally 10-20% of your total monthly expenses, will help you weather unexpected financial storms. Finally, review your budget regularly to ensure it aligns with your actual spending. Adjustments may be necessary as circumstances change.

Unexpected Expenses Renters Should Consider

Unexpected expenses are a common pitfall for renters. These can significantly impact your finances if not properly accounted for. Examples include: security deposit returns (often delayed or partially withheld), pest control, appliance repairs (refrigerator, washing machine), moving costs (beyond the initial move-in), and unexpected maintenance requests (plumbing issues, leaky roofs). Additionally, consider potential increases in utility costs during extreme weather conditions (high heating bills in winter, increased air conditioning costs in summer).

Even seemingly minor repairs can accumulate quickly, impacting your budget.

Negotiating Lower Fees or More Favorable Lease Terms

Negotiating with landlords can yield significant savings. While not all landlords are flexible, presenting a strong case can often result in more favorable terms. For instance, offering to pay a larger security deposit or signing a longer lease term can sometimes lead to a reduction in monthly rent. Similarly, you can negotiate the inclusion of certain amenities or services in your rent, such as parking or access to gym facilities.

Always approach negotiations professionally and respectfully, presenting your requests clearly and concisely. Be prepared to walk away if the landlord is unwilling to compromise on reasonable terms.

Sample Budget Spreadsheet Showing Impact of Hidden Fees

A budget spreadsheet is an invaluable tool for managing rental expenses. The following example demonstrates how hidden fees can impact overall costs:

| Expense Category | Monthly Amount | Annual Amount |

|---|---|---|

| Rent | $1500 | $18000 |

| Utilities | $200 | $2400 |

| Renter’s Insurance | $25 | $300 |

| Transportation | $150 | $1800 |

| Groceries | $300 | $3600 |

| Hidden Fees (e.g., pet fee, late fee) | $50 | $600 |

| Unexpected Repairs | $100 | $1200 |

| Total Monthly Expenses | $2325 | $27900 |

Note: This is a sample budget and the actual amounts will vary depending on individual circumstances and location. Hidden fees can significantly increase your overall annual cost.

Illustrating Common Scenarios

Navigating the world of apartment rentals can feel like a minefield, especially when unexpected fees pop up after you’ve already signed on the dotted line. Understanding common scenarios and potential pitfalls can empower you to be a more informed and protected renter.Unexpected fees can significantly impact your budget and overall rental experience. Let’s explore some real-world examples and strategies to handle such situations effectively.

A Renter’s Unexpected Fee Discovery

Imagine Sarah, a recent college graduate, excitedly signing her first apartment lease. Thrilled with her new place, she overlooks a seemingly innocuous clause mentioning a “processing fee” of $250. Only after moving in does she realize this fee wasn’t clearly explained during the initial walkthrough or mentioned in the initial rent quote. This unexpected $250 instantly cuts into her already tight budget, highlighting the importance of thorough lease review.

This scenario is surprisingly common, illustrating how easily hidden fees can catch renters off guard.

Consequences of Insufficient Lease Review

Failing to carefully review a lease agreement can lead to a cascade of negative consequences. Beyond unexpected fees, renters might unknowingly agree to unfair terms regarding late fees, pet policies, or even lease termination clauses. In Sarah’s case, the overlooked processing fee is a minor inconvenience compared to potentially facing exorbitant late fees or unfair eviction terms hidden within the fine print.

Ignoring the legal jargon can leave you vulnerable to financial burdens and legal battles you could have easily avoided.

Approaching a Landlord About a Questionable Fee

When faced with a questionable fee, a calm and professional approach is crucial. First, gather all relevant documentation: your lease agreement, any correspondence with the landlord, and proof of payment. Then, draft a polite but firm letter or email outlining your concerns. Specifically mention the fee in question, citing the clause in the lease (if applicable), and explain why you believe it’s unjustified or misrepresented.

For example, Sarah could write to her landlord, politely questioning the $250 processing fee, citing the lack of clear explanation during the lease signing process. She could request clarification and, if warranted, a partial or full refund. Maintaining a respectful tone while firmly asserting your rights is key to a positive resolution.

Visual Representation of Hidden Fees’ Impact

Imagine a bar graph. The left side represents a renter’s monthly budget, showing allocated portions for rent, utilities, groceries, and transportation. The right side depicts the same budget, but with a significantly smaller portion allocated to groceries and transportation. The difference? A large chunk has been secretly siphoned away by hidden fees throughout the year, accumulating to a substantial amount.

This visual demonstrates how seemingly small hidden fees can drastically impact a renter’s financial stability over time, forcing cutbacks in essential areas of their budget. The accumulated impact of these hidden fees is far greater than the initial individual cost.